Binance Witnesses 5000 BTC Withdrawn in Just 60 Seconds

🚨 🚨 🚨 🚨 🚨 4,000 #BTC (106,039,171 USD) transferred from #Bitfinex to unknown wallethttps://t.co/982bCEb4SO

advertisement— Whale Alert (@whale_alert) August 24, 2023

However, besides the one-minute wonder, a six-day streak from August 17 showed Bitcoin outflows dominating the Binance exchange. Hence, by August 22, 14,460 BTC found their way out of Binance’s reserves.

Recommended Articles

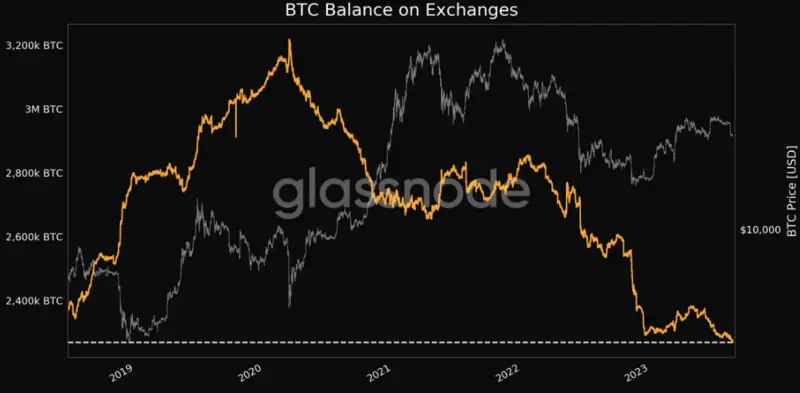

Moreover, Binance is one of many platforms seeing such massive withdrawals. Glassnode’s recent insights highlighted a 5-year low for BTC balances across all major exchanges.

BTC Balance on Exchages (Source: glassnode)

Consequently, fewer than 2.27 million BTC remain in known exchange wallets. Additionally, these shifts point to ‘HODLers’ preferring the safety of private wallets, indicating a potential reluctance to sell their holdings in the immediate future.

Fee Overhaul at Binance

Additionally, with Binance’s pivot from a zero-fee Bitcoin trading model starting September 7, the dynamics of its BTC/TUSD trading pair will undergo a significant transformation. The days of enjoying zero-maker and taker fees are ending. Moreover, while the maker fees will hold zero status, taker fees will now hinge on the user’s VIP level.

#Binance will update the zero-fee Bitcoin trading program effective from September 7, at 00:00 UTC.https://t.co/nlHvZU4ZJ0

— Binance (@binance) August 24, 2023

With Binance phasing out BUSD support in favor of TUSD, a noticeable drop in Tether (USDT) volumes came to the fore. Many seasoned traders and crypto enthusiasts see this as a pivotal moment with far-reaching market implications. Consequently, as this new crypto phase looms, all eyes remain on Binance’s subsequent moves and the overarching market aftermath.

The crypto sphere is experiencing some noteworthy shifts. The landscape is evolving with changes in trading fee structures and substantial BTC withdrawals. As these events unfold, market players and enthusiasts will watch closely, anticipating the next significant turn.